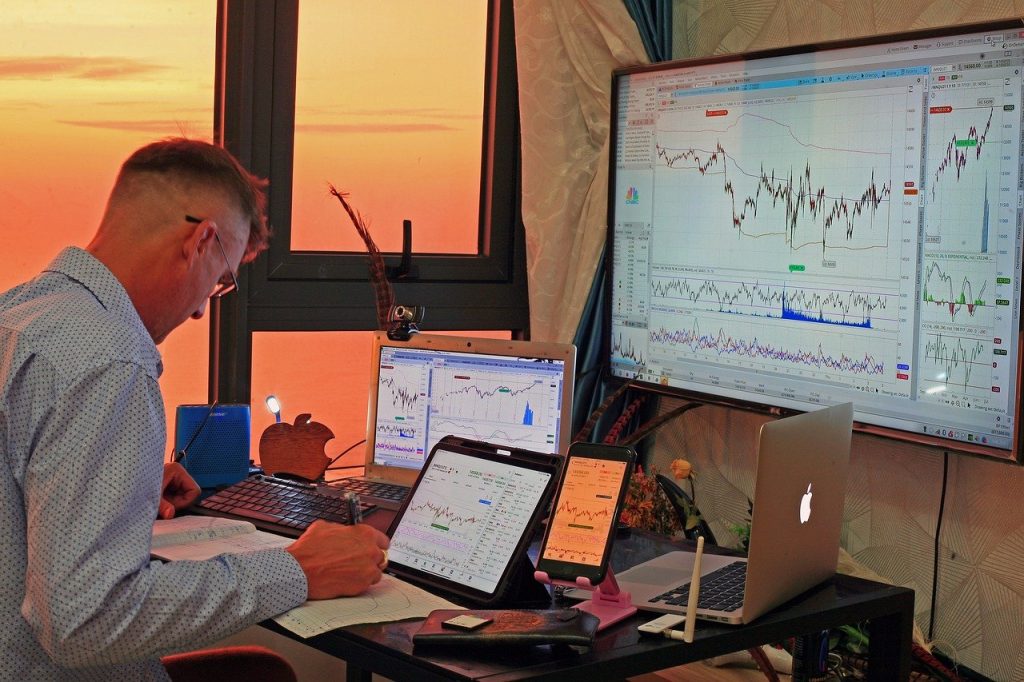

Financial markets – and especially the forex market – are where risk management and psychology play a key role. Although losses are an inseparable part of investing, every investor wants to minimize them and strives to achieve the highest possible profits. Below we present 5 strategies that will allow you to increase the effectiveness of investment decisions of every investor.

How to understand it…

Remember the psychological aspect of investing – financial markets are a constant struggle between supply and demand, the intensity of which is influenced by emotions – greed and fear. Every investor experiences emotions, and the ability to control them not only opens up new perspectives and makes investing more rewarding, but can also allow you to achieve more stable results.

Gain knowledge and plan your actions – knowledge is important and allows you to take advantage of opportunities, m.in. through repeated patterns in the market. While building a strategy based solely on repeated past scenarios is not an optimal method in itself, understanding price behavior can allow you to spot more trading opportunities.

Stick to the strategy and learn to adapt it – An investment strategy is a key component of operating in the market. Following proven rules will allow you to minimize the risk of loss and increase your chances of making a profit. However, you cannot become a slave to your own strategy – especially when some of its elements stop working or need to be improved. The best traders are able to adjust their strategy based on their performance.

Use defensive orders – defensive orders allow you to minimize the risk of deep losses and forced liquidation of positions thanks to the “margin call” mechanism. Knowledge of technical analysis can help you locate key support and resistance levels on the chart, which can serve as a place to set defensive orders. By using defensive stop loss and take profit orders, the trader can minimize screen time.

Invest amounts you’re not afraid to lose – how big of a position you manage relative to your capital is fundamental to your perception of risk and the level of stress you feel. When the position is too big, you can start making psychology-based mistakes. The intensity of the emotions you feel, such as greed and fear, will then be higher.

Following the above strategies does not guarantee that you will make profits in the market, but it does significantly minimize the likelihood of making a loss. The forex market is influenced by many factors, such as geopolitical risk or changes in the monetary policy of central banks. Macroeconomic data releases can also have a significant impact on exchange rates and investors’ active positions. It is important to remember that losses are an inseparable part of investing, and the most important skill of an investor – apart from finding attractive investment opportunities – is to maintain control over possible losses and ensure that their level does not exceed the level of profits achieved.

Short selling

At the moment of a bear market, when the prices of most assets are falling, opening a short position seems to be the only sensible strategy. Using CFDs, a trader can open a short position on a selected asset and profit from its price falling.

In a short selling strategy, proper capital management is crucial. Price declines in the market tend to be more dynamic than increases, which means that a properly taken short position can quickly bring profits to the investor. An example is the behavior of stock indices in the face of the bankruptcy of Lehman Brothers, or during the crash related to the Covid-19 pandemic.

Defensive orders – stop loss and take profit

As mentioned above, CFDs are leveraged instruments, which means that their volatility is usually high. Investing in currencies using CFDs can therefore be risky, but there are ways to minimize the risk of losing your capital. These include defensive stop loss and take profit orders, which allow you to automatically close an active position when the market reaches a certain level. To know exactly where to set the stop loss or take profit level, it is worth familiarizing yourself with the principles of technical analysis.

- Stop Loss

As the name suggests, a stop loss order can protect a trader from deepening losses by automatically closing the position when the price falls below a certain level. Stop loss orders should be included in any investment strategy because they reduce the risk of losing your capital. A stop loss order can follow the price – then we are talking about trailing stop loss. Using a ‘trailing’ stop loss is an interesting alternative to ‘standard’ stop loss orders, as it can help you maximise the potential profit of your trades while limiting your overall position risk level.

- Take profit

A Take Profit order allows you to automatically close your position at a price level indicated by the trader. The closing level can be based, for example, on technical analysis of a chart, or any other form of analysis that the investor deems appropriate.

You can find more information about Defense Orders in this article or on the xStation 5 platform, in the Education tab, where we present instructional videos.

Risk of leverage

The use of financial leverage brings with it both the opportunities associated with the possibility of opening a large position with a relatively small amount of capital employed, but also greater volatility of investment results and a higher risk of loss. When trading with CFDs, the amount needed to open a position is called margin and is a fraction of the notional investment amount. To explain this issue in detail, let’s use an example:

A trader would like to open a long position of 0.01 lots on EURUSD. 1 lot is the standard position size on the Forex market, which is equivalent to 100,000 units of the base currency. The leverage level on EURUSD is 1:30, which means that we need 3.33% of the notional value of the position to open a position. To open a position of €1000 (0.01 lots x 100,000 units of the base currency), you will need a margin of €33.

When using leverage, it is crucial to familiarize yourself with the term Margin Level. This is an indicator that helps to assess the impact of active positions on the value of the entire account.